What the heck were the Trumpists thinking?

| "Earlier this week the Trump administration triumphantly announced that it had scored a big trade deal with Japan. Now the reviews are in, and the deal basically received a 0% score on Rotten Tomatoes. And I’m not talking about the reactions of economists; I’m talking about the reaction from the manufacturing sector, both management and labor, which Trump’s tariffs was supposed to help. |

Why so negative? I’ll get there shortly. First, let’s talk about the overall state of Trump’s trade war.

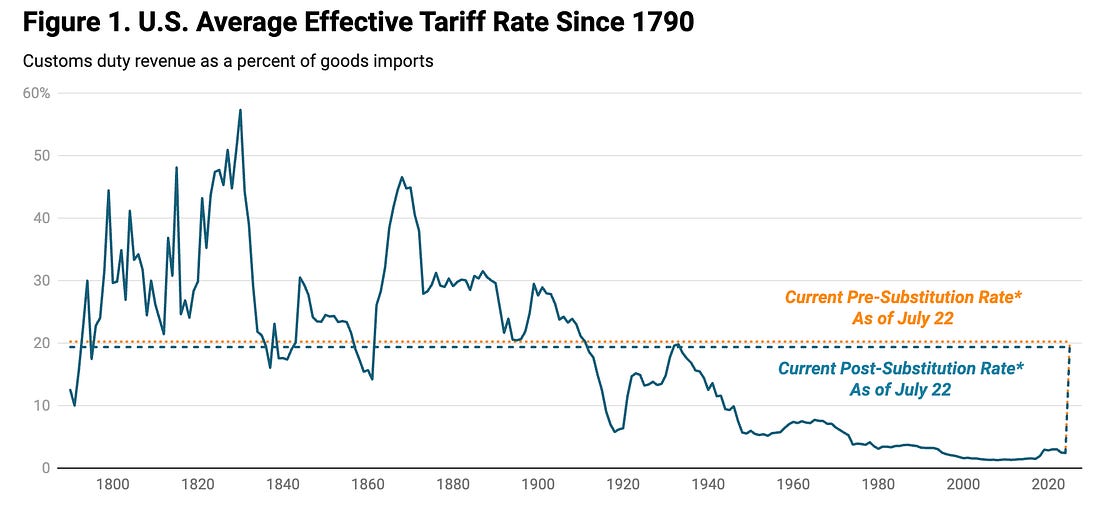

Under Trump, the United States has taken an amazingly sharp turn toward protectionism. Here’s the long view:

Source: Yale Budget Lab

In a matter of months, we’ve gone from a regime of very low trade barriers — achieved through generations of hard bargaining in international trade negotiations — to Smoot-Hawley-level tariffs. Many businesses, however, have taken comfort in the belief that extremely high tariffs were temporary, that they’d come back down as Trump began making deals with other nations.

But Japan has struck a deal — and is left facing a tariff of 15 percent, compared with an average of 1.6 percent BT (Before Trump.) Reports suggest that a similar deal may be coming with the European Union. At this point it looks as if we’re heading for a new normal in which most imports are taxed at 15 percent, while some face even higher tariffs.

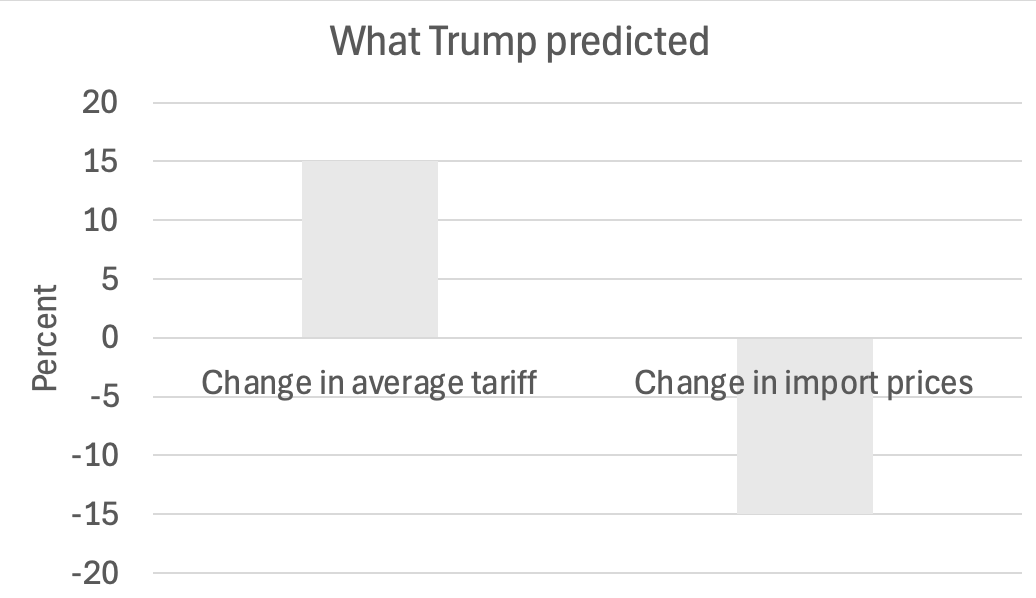

Trump claims that foreigners will pay these tariffs, and Trump apologists are pointing to consumer prices, which haven’t yet shown a clear spike, as evidence that he’s right. But they’re looking at the wrong price measure. What you want to look at are import prices — the prices foreign producers are charging America, prices tracked by the Bureau of Labor Statistics.

If Trump were right, we’d be seeing a large fall in import prices, offsetting the tariff hikes. It would look like this:

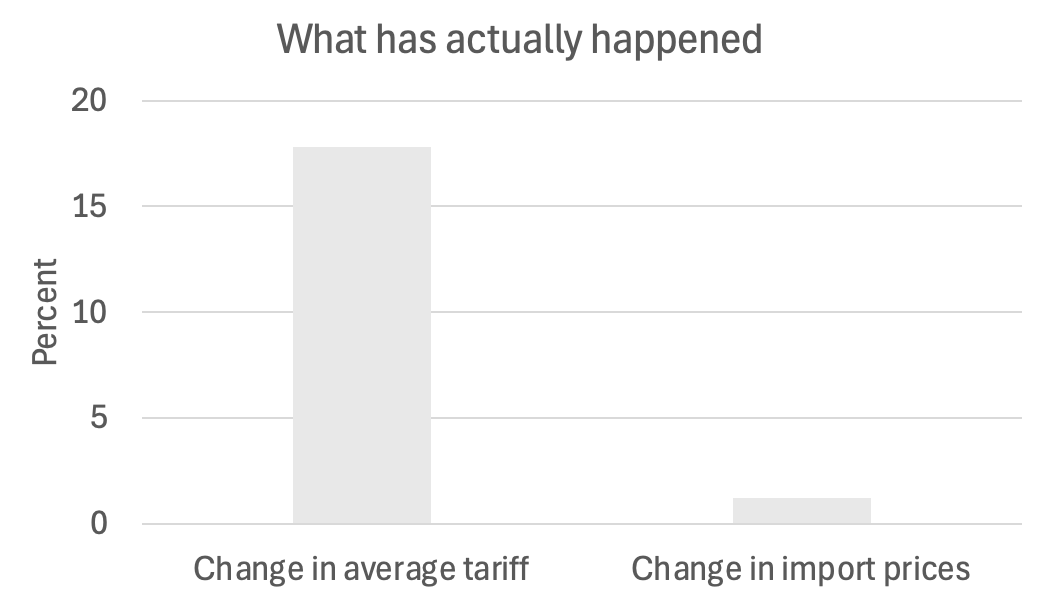

What we actually see is this:

Source: Yale Budget Lab, BLS. Import price is change in non-fuel index from year ago.

That is, if you look at the right price measures, foreigners don’t seem to be paying any significant share of the Trump tariffs.

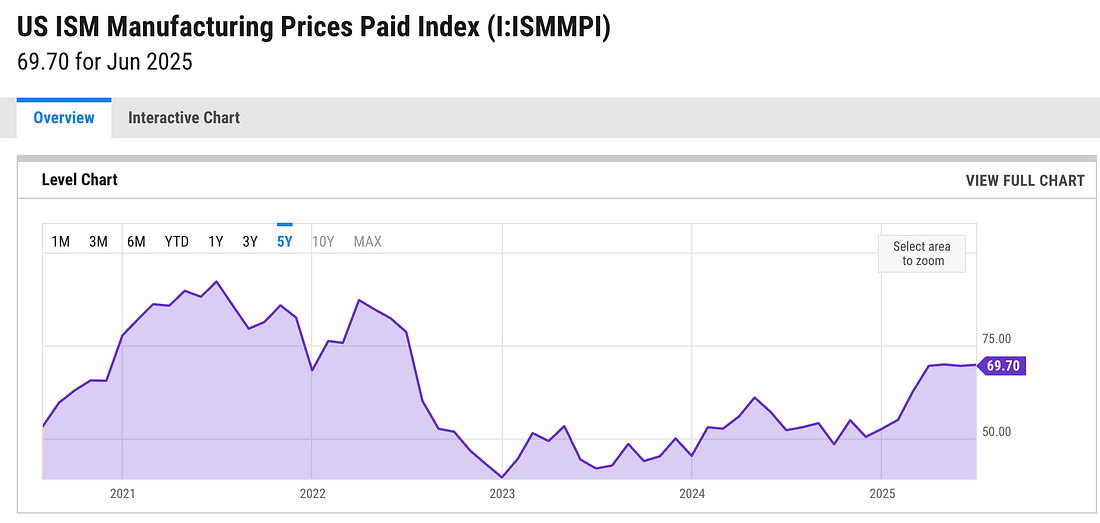

Who is paying? So far, the burden seems to be falling mainly on U.S. businesses, which are definitely seeing a sharp rise in costs. Look, for example, at the Institute for Supply Management’s report on manufacturing, which asks purchasing managers whether their costs have risen. The percentage answering yes has historically been a very good predictor of inflation a few months down the pike. And we’re currently experiencing cost inflation at levels not seen since the summer of 2022:

Source: YCharts

So far, these costs haven’t been fully passed on to consumers, probably in part because businesses have been expecting tariffs to come down. But once businesses see how high tariffs on Japan and Europe are afterthey’ve made deals, their willingness to absorb the tariffs rather than passing them on to consumers will evaporate.

So U.S. consumers will soon be suffering. But why are U.S. manufacturers so upset with the Japan deal? Because in combination with Trump’s other tariffs this deal actually leaves many U.S. manufacturers worse off than they were before Trump began his trade war.

This is clearest in the case of automobiles and automotive products. Trump has imposed a 25 percent tariff on all automotive imports, supposedly on national security grounds. This includes imports from Canada and Mexico. And here’s the thing: Canadian and Mexican auto products generally have substantial U.S. “content” — that is, they contain parts made in America. Japanese cars generally don’t.

But now cars from Japan will pay only a 15 percent tariff, that is, less than cars from Canada and Mexico.

OK, it’s not quite that straightforward, because imports from Canada and Mexico receive a partial exemption based on the share of their value that comes from the United States. Yes, it’s getting complicated. But we may nonetheless now be in a situation where cars whose production doesn’t create U.S. manufacturing jobs will pay a lower tariff rate than cars whose production does.

Wait, there’s more. Trump has also imposed 50 percent tariffs on steel and aluminum, which are of course important parts of the cost of a car. Japanese manufacturers don’t pay those tariffs.

Overall, the interaction between this Japan deal and Trump’s other tariffs probably tilts the playing field between U.S. and Japanese producers of cars, and perhaps other products, in Japan’s favor.

If this sounds incredibly stupid, that’s because it is. So how did this happen?

You might imagine that making a deal with one of our most important trading partners must have involved a team of experienced, skilled negotiators backed by economic experts. But in reality it was clearly pure amateur hour. Look at the photo at the top of this post, from CNBC. It shows Trump with a card in front of him laying out one much-hyped though probably meaningless part of the deal, a promise by Japan to invest in America. How much? The card says $400 billion, but that number was crossed out by hand and replaced with $500 billion, which somehow became $550 billion in the final announcement.

Next thing you’re going to tell me that Trump will start modifying weather forecasts with a Sharpie. Oh, wait.

So Trump’s negotiators probably had no idea what they were doing, and didn’t realize that in their frantic rush to conclude a deal they were agreeing to tariffs that would be highly unfavorable to U.S. manufacturing.

Why were they frantic? Trump has been the subject of considerable mockery over having made big promises about his ability to negotiate trade deals, then coming up empty month after month. So he and his people were surely anxious to make some major announcements before his self-imposed deadline of Aug. 1 — anxious enough not to realize quite what they were agreeing to.

And of course they may also have hoped that a splashy trade deal would move the news cycle off Jeffrey Epstein.

Now that other countries have seen what Japan was able to get away with, I won’t be surprised if we see more deals in the near future. Will these deals be just as stupid? Probably."

No comments:

Post a Comment